Bristol Myers Squibb’s Price Hikes and the Impact on Healthcare Costs

Pharmaceutical giant, Bristol Myers Squibb (BMS), has come under scrutiny for increasing the prices of over a dozen prescription drugs in 2022, and nearly 20 prescription drugs in 2023, including blood thinner Eliquis. This move has sparked concerns about the implications of rising healthcare costs on patients and has reignited the ongoing debate on the pharmaceutical industry’s pricing strategies.

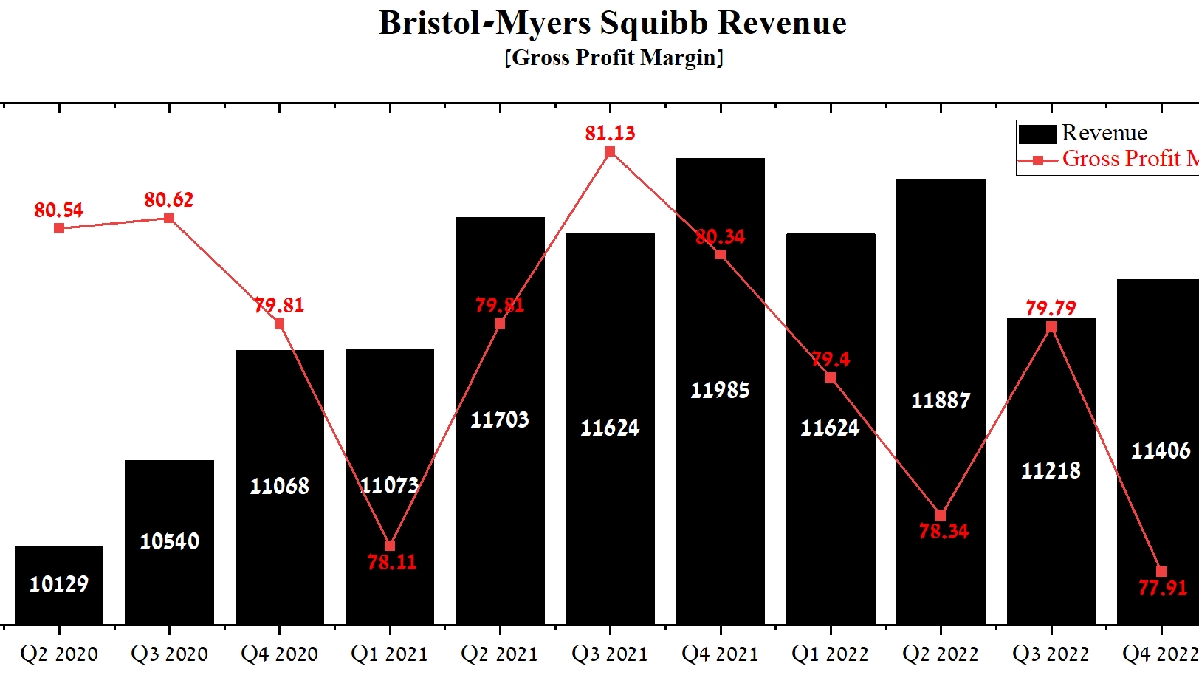

BMS’s Rising Profits Amidst Controversy

BMS reported net earnings of $8 billion in 2023, a significant increase from $6.4 billion in 2022. However, the company has faced criticism for pricing disparities. BMS has been accused of charging U.S. patients $7,100 for Eliquis, while the same medication is available at a fraction of the cost in other countries. In fact, Eliquis alone contributed nearly $8.6 billion to BMS’s revenue in the United States in 2023, marking a 10% increase from the previous year.

BMS, along with Pfizer, has increased the price of Eliquis by 124% since its launch in 2012. The pharmaceutical giant is among those suing to maintain the existing pharmaceutical system, which has been criticized for fostering price gouging and burdening seniors with high out-of-pocket costs. BMS is currently in legal action against the Biden administration to prevent the implementation of Medicare’s new negotiation power.

BMS’s Performance and Future Growth Opportunities

Despite the controversy, BMS reported strong portfolio diversification and pipeline acceleration for 2023. The company achieved multiple regulatory and clinical milestones, particularly in their oncology category. New approvals and expansions for drugs such as Augtyro, Breyanzi, and Opdivo indicate BMS’s focus on delivering strong commercial execution and accelerating growth opportunities in 2024.

Moreover, BMS’s CEO has outlined a transition strategy featuring 11 key brands and continued dealmaking to navigate the company through upcoming patent cliffs and new government-mandated pricing pressures. With BMS’s legacy portfolio raking in $25.6 billion in sales in 2023, the company expects revenues to increase by low-single-digit percentages in 2024.

Pharmaceutical Industry Reforms and the Inflation Reduction Act

The Inflation Reduction Act is expected to bring significant changes to the pharmaceutical industry. This includes the initiation of Medicare price negotiations, caps on out-of-pocket costs and insulin prices, and rebates from drug companies. The Act is expected to save nearly 19 million seniors and other Medicare Part D enrollees $400 a year by 2025.

However, the pharmaceutical industry is pushing back against these reforms. BMS, for instance, is preparing for these price negotiations and has suggested that Eliquis’ period of significant growth may end in 2025 due to these changes.

Senate Hearing on High Drug Prices

Amidst the ongoing discussion around skyrocketing drug prices, the Senate Health Education Labor and Pensions Committee, chaired by Sen. Bernie Sanders, held a hearing with the CEOs of pharmaceutical companies, including Johnson & Johnson, Bristol Myers Squibb, and Merck. These companies are facing public outrage over high drug prices and are being questioned about their commitment to research and development in lieu of profiteering.

The soaring launch prices of new drugs and the perceived lack of focus on research and development by these companies have prompted calls for fundamental reforms in the pharmaceutical industry. These reforms are seen as necessary steps to ensure that healthcare remains accessible and affordable for all.

#Bristol #Myers #Squibbs #Price #Hikes #Impact #Healthcare #Costs